Coastal Risk News & Press

Climate Risk Assessment Moves from Blind Spot to Business Critical

The commercial real estate industry is reaching a tipping point as climate risk data becomes more accessible, yet most transactions continue to overlook its importance.

RiskFootprint™ Releases Version 18, Restoring FEMA’s Discontinued National Risk Index Loss Data

RiskFootprint™ Releases Version 18, Restoring FEMA’s Discontinued National Risk Index Loss Data and Setting a New Standard for Property-Level Climate and Hazard Intelligence.

What is RiskFootrpint?

A Comparative Analysis and Sector-Specific Recommendations. Microsoft Copilot was used to help synthesize vendor landscape information, structure comparative frameworks, and draft sector-specific recommendations.

RiskFootprint™ & the Future of Resilience-Based Hazard Assessment

Mr. Albert J. Slap (Coastal Risk Consulting, LLC) introduces RiskFootprint, a breakthrough SaaS technology delivering site-specific, physical #hazard and climate vulnerability insights for commercial realestate and lending, insurance advisory, government buildings, and critical infrastructure.

Our Schools, Our Shelters

This video podcast outlines the urgent necessity for U.S. schools to address severe and growing risks associated with floods, natural hazards, extreme weather and climate change. It uses harrowing examples, such as the Lahaina wildfire and Hurricane Katrina, to illustrate how widespread destruction of school facilities leads to massive learning loss and community trauma.

Commercial Lending – Real Estate’s Blind Spot

Commercial lenders need to better understand the risks of natural hazards and extreme weather in their loan underwriting and credit processes. RiskFootprint(tm) and the ASTM’s Property Resilience Assessment process will help.

The ASTM PRA and Retrofitting for Resilience

Owners, operators, and investors in commercial real estate need detailed information about exposures to natural hazards and extreme weather, building vulnerability, value-at-risk, and feasible resilience measures and costs to determine the ROI of resilient retrofits. RiskFootprint(tm) has the answers you need.

B-Resilient™ Process – The Future of Value

Commercial real estate lenders need to better understand the impacts of natural hazards and extreme weather on the appraised value of properties.

Commerical Lending – Smart Risk

Commercial Loan Underwriters and Credit Officers will benefit from using the new ASTM International’s Property Resilience Assessment Stage One and the RiskFootprint(tm) Hazard/Climate Risk Assessment. RiskFootprint(tm) completely satisfies ASTM PRA Stage One.

Your Home’s Future – Homebuyers and Realtors

This video podcast explains to residential homebuyers and buyer-side realtors the enormous due diligence value of the online RiskFootprint™ hazard/climate report. The $200 RiskFootprint™ report is an essential part of due diligence, providing comprehensive risk assessments superior to limited scores offered by online residential real estate platforms.

The Resilience Cycle – Annual Resilience Updates for CRE

This video podcast details a structured, annual maintenance plan for commercial real estate designed to enhance and preserve a building’s safety and resilience, emphasizing that resilience is a continuous process rather than a final state.

B-Resilient – Future of Value

Watch the B-Resolient: Future of Value video

Turning Routine Retrofits into Strategic Resilience Investments

Most hazard and climate risk vendors stop at “assessment to reporting.” They deliver data, maps, and scores—but leave stakeholders stranded at the decision-making threshold. RiskFootprintTM solves this problem by bridging the gap between exposure data and actionable insight, empowering commercial real estate (CRE) professionals to make better informed “go/no-go” decisions on resilience retrofits.

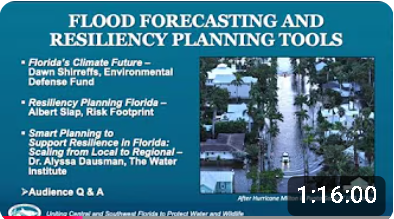

Flood Forecasting and Resiliency Planning Tools

Climate change refers to long-term shifts in temperatures and weather patterns. Human activities have been the main driver of climate change, primarily due to the burning of fossil fuels like coal, oil and gas.

‘All Hands on Deck’: King Tides Return as Hollywood Works to Stay Above Water

As groundwater levels creep upward and traditional drainage systems become overwhelmed, the Florida Department of Transportation is working on new climate-resilient infrastructure projects designed to protect one of the region’s busiest coastal roads.

From Assessment to Certification: The RiskFootprint™ B-Resilient™ Six-Step Process.

Purpose of the Six Step process – The B-ResilientTM Six Step Process provides large building owners with a disciplined system to manage their core assets from initial assessment and regulatory reporting on to needed resilient retrofit and even certification of completion.

RiskFootprint™ Leverages the FEMA National Risk Index and Hazus

Excited to share a video highlighting how the RiskFootprint™ hazard/climate assessment utilizes extensive data and modeling from FEMA’s National Risk Index and Hazus Damage/Loss software. Discover how this tool empowers informed decisions for resilience and supports the implementation of the new ASTM Property Resilience Assessment.

From National Risk Index to Hazus: Building Resilient Decisions with RiskFootprint

Every building faces risks from natural hazards — but understanding how much risk is the first step to protecting investments and strengthening resilience.

EBA Journal: Summer 2025 Edition by Envirobank

As is prudent, owners/investors need to determine if there may be a positive ROI or Benefit/Cost in resilient retrofits. ROIs may include damage prevention, fewer business interruptions, greater tenant satisfaction, maintaining market values, and, last but not least, insurance premium lowering or stabilization in the future

Meeting the Moment: How the New ASTM Property Resilience Assessment Standard Aligns the Needs of Commercial Real Estate and Insurers in a Changing Climate

What do commercial real estate owners and their insurers need in the face of climate-driven risk and increasing insured losses—and how does the new ASTM Property Resilience Assessment (E3429-24) meet those needs?