B-Resilient™ Risk Reduction Process

B-Resilient™ 6-Step Process to Accelerate Resilience

Risk Assessment Services

Risk Advisory Services

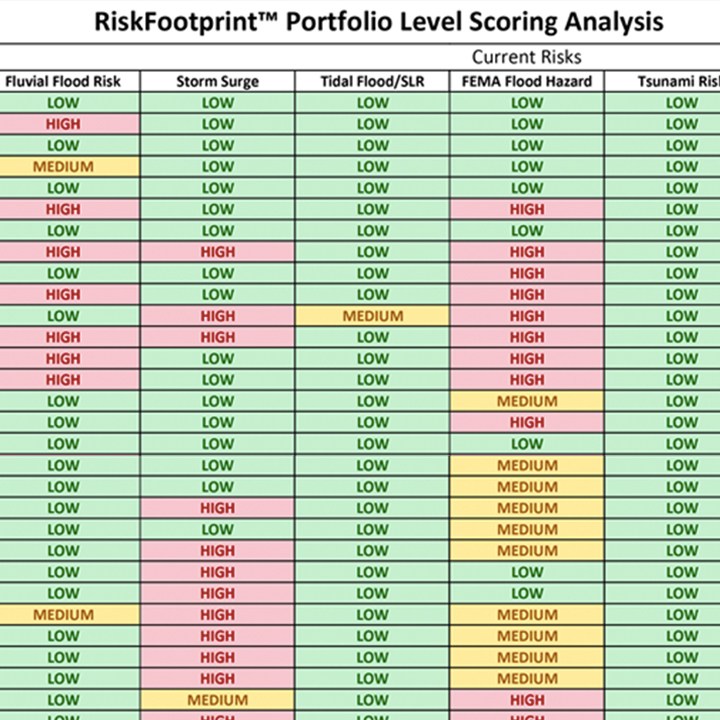

Portfolio Risk Screening

.

Property-Level Risk Assessment

Damage/Loss Calculations

.

Risk Mitigation Cost Estimation

Recommend Solutions

.

Implement Solutions

.

ACTIONABLE INSIGHTS TOWARD IMPLEMENTING SOLUTIONS

More frequent and costly floods, natural hazards and climate change impacts have brought with them negative impacts on physical building assets, business continuity and asset values. Our assessments of flood, natural hazard and climate change impact risks for an individual property or multiple locations add to your due diligence risk management. The RiskFootprint™ Dashboard platform provides users with both qualitative risk scoring for portfolio properties and quantitative, RiskFootprint™ Reports for existing and potential acquisition properties..

Portfolio risk screening

There’s a lot of good science out there to help individuals, corporations and governments make their critical assets safer and more resilient to floods, natural hazards, and climate change impacts. Most asset owners don’t even use the science that’s available to determine if risk mitigation investments are cost-beneficial.

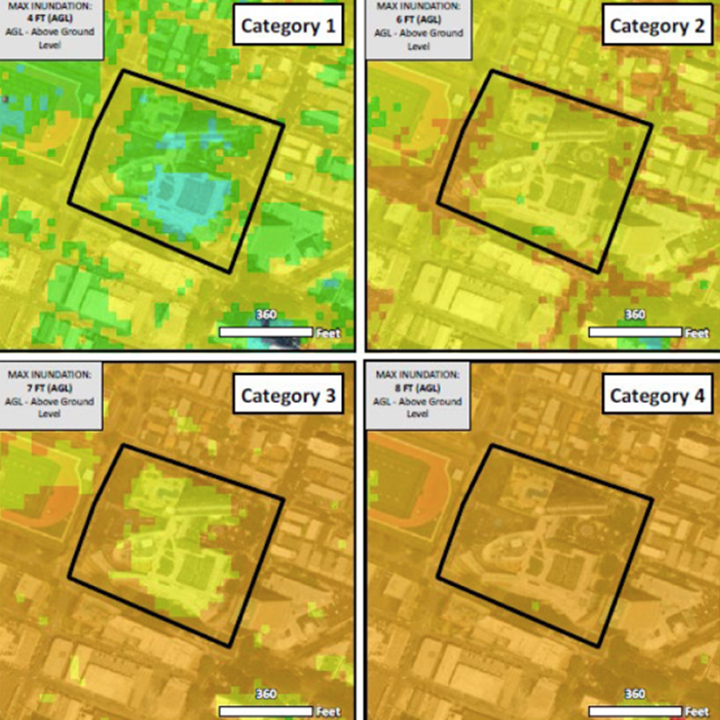

Property-level risk assessment

The second step in this process is to order and review in-depth, RiskFootprint™ Reports for buildings at highest risk (and neighborhood and supply route impacts). These site-specific reports will include quantitative, threat probabilities, inundation depths and other important analytics (e.g., visualizing areas of the property/building most at risk). This analysis is performed at a high level of granularity.

Damage/Loss Calculations

Determining the cost of risk mitigation for any particular property is not difficult. Architects and engineering or other specialized vendors can provide this information. But, in order to determine the cost-benefit of risk mitigation investments, an owner needs to understand the “benefit”. What is being gained from the risk mitigation investment and, is it worth the cost? Can the potential damage simply be covered by insurance? Coastal Risk’s technology provides estimates of “avoidable” damage and loss from floods and natural hazard events for the owner to determine the ROI of the protective investment.

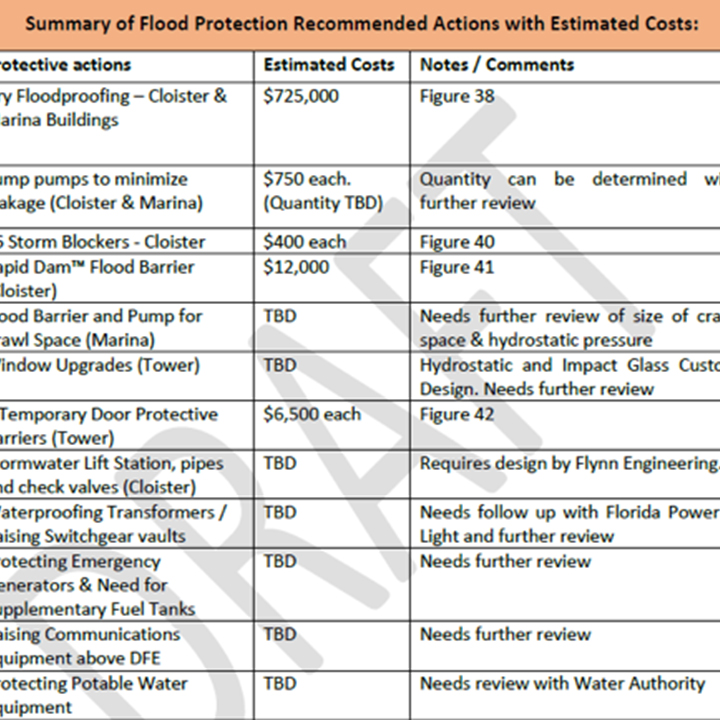

Risk mitigation cost estimation

Step Four entails an evaluation, at the concept level, of cost-effective, risk mitigation (adaptation) options that may be available to reduce the risk and vulnerability to specific assets, also taking the asset’s criticality into account. Step 4 typically involves engaging specialized experts who can help the client match the risks identified in Steps 1- 3 with remedies that are relevant and available.

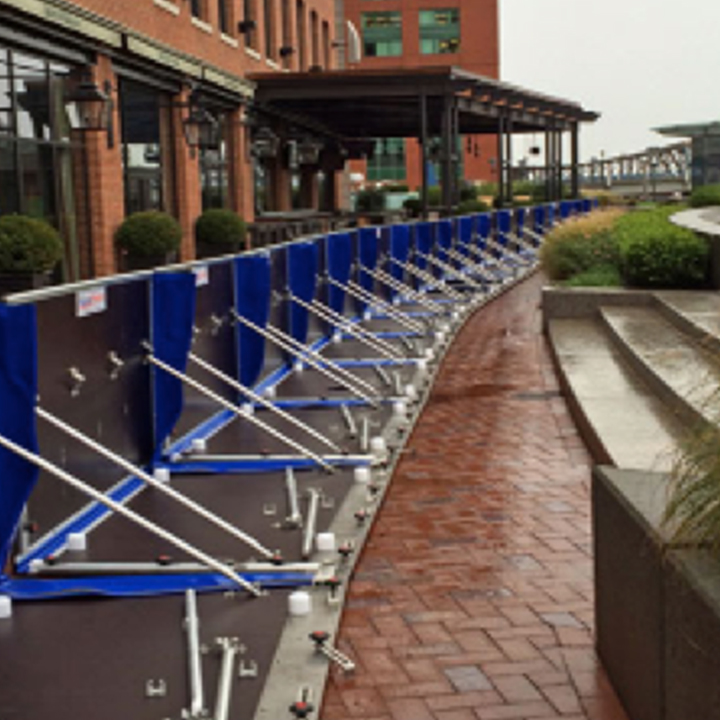

Instead of just providing clients with the “bad news” and leaving them hanging when they ask, “what do we do next”? Coastal Risk will deploy its ecosystem of experts to assist the client accelerate its resilience. Step Four generally identifies applications that will mitigate some or all of the risks. These may include such measures as: flood barriers; dry floodproofing, improved storm sewers, improved roofing to prevent wind damage; enlarged roof drains to prevent water intrusion; hurricane windows and shutters; elevation of electrical and communications equipment; replacement and upgrade of AC chillers to reduce energy costs: improved emergency response plans, etc.

Recommend solutions

In Step 5, Coastal Risk matches the potential mitigation remedies with the risks to the building and makes specific recommendations of solutions and, more definite cost estimates are provided.

IMPLEMENT solutions

We have found that while some real property owners/operators, investors, lenders, tenants, etc. may have obtained “high-level” climate change risk assessments, few have any specific plans of action to mitigate those risks. Coastal Risk doesn’t leave its risk assessment clients hanging when they ask, “OK. That’s the bad news. What do I do, next?”

We partner with our clients to develop a bespoke program to accelerate their assets’ safety and resilience. We refer to this as our 6-step, B-Resilient™ business process. This process helps companies determine if “at risk” properties should be targeted for mitigation investments or, in some cases, divestment. This will permit companies to maintain profitable assets, while making them more resilient.

An important part of our B-Resilient™ process is the Advisory Services division of Coastal Risk. We call this our Ecosystem of Experts™. We deploy on the client’s behalf a wide-array of national and internationally-recognized climate scientists, engineers, architects, storm water and flood mitigation, and regulatory permitting experts.

Why

Should You

B-Resilient™

Over the past 40-years, the number of natural disasters causing financial losses in excess of $1 billion has risen steadily. Since 1980, the U.S. has sustained 258 weather and climate disasters exceeding $1 billion. The cumulative cost for these events exceeds $1.75 trillion.

During 2019, the U.S. was impacted by 14 separate billion-dollar plus disasters, including: 3 major inland floods, 8 severe storms, 2 tropical cyclones (Dorian and Imelda), and 1 wildfire event. 2020 marked the sixth consecutive year (2015-20) in which 10 or more billion-dollar plus disaster events have impacted the U.S.

As a result of these trends, real estate investors, owners and operators, lenders and other stakeholders need to better understand individual building risks, including the risks in surrounding communities, and the cost and benefits of risk mitigation investments. Until recently, the availability of detailed, location-specific information has been limited. This situation has changed with new technologies such as the RiskFootptint™ Report from Coastal Risk.

New technologies, such as B-Resilient™ and RiskFootprint™, improve both risk management and resilience of commercial real estate through better assessment of building-specific risks and mitigation options in order to protect assets and values and ensure business continuity by making new and existing buildings more resilient to floods, natural hazards and climate impacts. With new technologies entering the market, CRE investors, asset owners and building occupiers can introduce more systematic assessments of building exposures and vulnerabilities.

A best practice assessment tool is Coastal Risk’s B-Resilient™ program, which covers flood, natural hazards and climate impact risks, for every property in the US and many areas, globally. This holistic risk assessment program improves understanding of hazards, reduces vulnerability, and helps structure plans for risk mitigation investments and business emergency procedures.

New Technology is Here & Now

Accelerate Resilience. We’re here to help.